Business expenses

made seamless like your

personal UPI spends

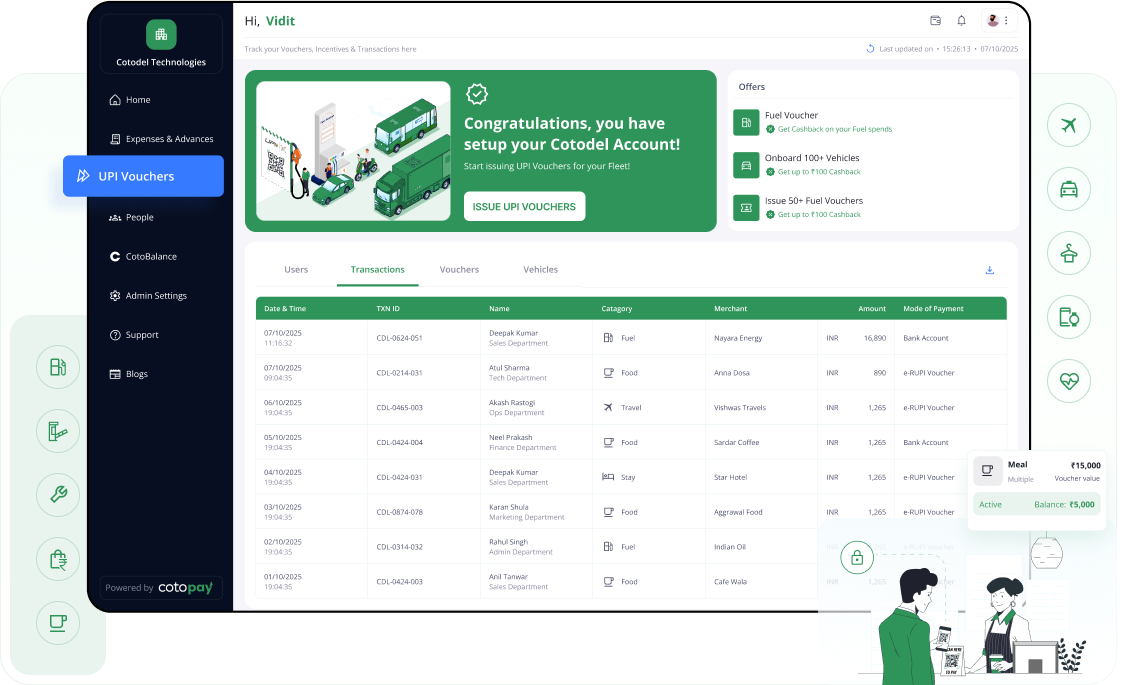

Seamlessly issue, manage & track your Business expenses with CotoPay's UPI Vouchers powered by e-RUPI!

Seamlessly issue, manage & track your Business expenses with CotoPay's UPI Vouchers powered by e-RUPI!

UPI Vouchers powered by e-RUPI can be issued on-demand from a Business dashboard to all employees seamlessly with CotoPay

We trust UPI for personal spends. Why not for business expenses? Because business needs control and now, UPI gives you that too.

Yes, now with CotoPay, you can actually lock the purpose for which you want the spend to be done and all of this

while using the existing UPI apps & QR codes!

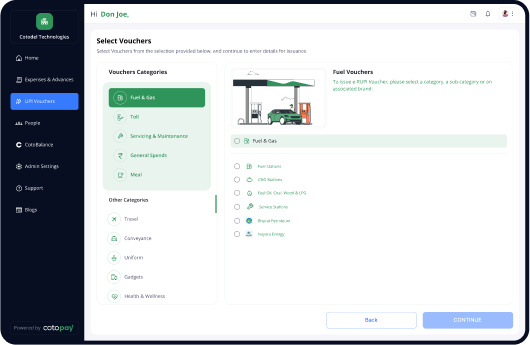

Lock spends at a Category level

Lock spends at a Brand level

Lock spends at a Merchant outlet level

Employee makes transaction using existing UPI apps

Merchant accepts payment at the existing QR Code

Business manager uses CotoPay’s Platform to select relevant category spends, enter voucher amount and define time validity to issue UPI Vouchers powered by e-RUPI to each driver partner

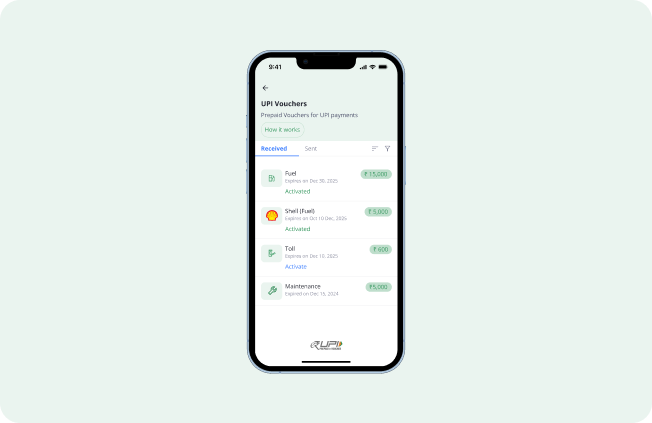

All UPI Vouchers issued to Driver's number get aggreagted in e-RUPI section of their UPI Apps.

Driver scans Merchant's existing QR Code to make payment using e-RUPI Voucher on their existing UPI Apps.

Basis Merchant eligibility, relevant UPI e-RUPI Voucher pops-up automatically for payment at time of transaction.

Fleet Expense Management

Corporate Expense Management

Corporate Expense Management

Business spends solution for Consulting & White-collared companies

View More

Seamless Control over Issuance

Set-up Budgets and Parameters to issue vouchers across Employee Bands and Categories

Full Control over Money

Money never leaves a Company’s Bank Account till the transaction is done by the employee using UPI Voucher

Reduction in Bill Frauds & Admin Tasks

No Paper-work or burden associated with Admin task of issuing vouchers and verifying spends

Automatic Digital Reconciliation

Minimize money leakages by having an automated reconciliation and get UPI data of all transactions done on your dashboard

Convenient Form Factor

UPI is the preferred payment method and there is no need to carry a new physical/digital card or pay through a new app

Seamless Onboarding without KYC

No KYC is needed for each beneficiary as onboarding is made seamless through the existing UPI apps only

Higher Redemption Touchpoints

Leveraging the biggest payment network, users make payments on existing merchant QR codes, POS Machines, Online platforms

Manage Reimbursements seamlessly

Users can pay using UPI vouchers issued by their company without worrying about the hassles of reimbursement process

We are here to make your Business expenses as seamless as your personal UPI Spends while maintaining control and visibility for each business!

CotoPay is committed to delivering a reinvigorated approach to how business spends are done. UPI has become the de-facto form of payment for all of us so why not have the same for all of our business payments as well? No matter the industry or size of your organisation, we want to help you provide a seamless experience when it comes to your business payments.

Programmability of money now on UPI! We are here to ease everyone’s professional lives and we do this by using the existing UPI ecosystem for issuing e-RUPI prepaid vouchers that can be redeemed across any of the existing UPI apps. The objective is to streamline the payments process by providing complete transparency and traceability to the issuer and bringing convenience to the end-user.

Industry-relevant experiences across Payments, Consumer, Tech & Scale

CotoPay is built on e-RUPI payment solution launched by National Payments Corporation of India (NPCI)

Tailored access for administrators, issuers, and analysts.

Just link your bank to get started effortlessly.

Easily integrate with your existing application through our secure APIs.

Built for high-performance environments to scale easily.

Two-layer security with end-to-end encrypted data flow.

Lock e-RUPI vouchers at the merchant level via our API for enhanced control.

CotoPay's UPI Vouchers powered by e-RUPI can be locked at multiple categories!

For any other questions, please feel free to Contact Us to transform how your Business expenses are done.

Something interested you? Want to discuss anything?

CotoPay is here to help!

Thoughts from us & other industry leaders, providing actionable insights around payments and business spends!